“I just love waiting 3–6 months,

needing collateral, and great credit

for a loan approval from a bank—

said no small business owner ever!

”

When the bank says no, you still have options.

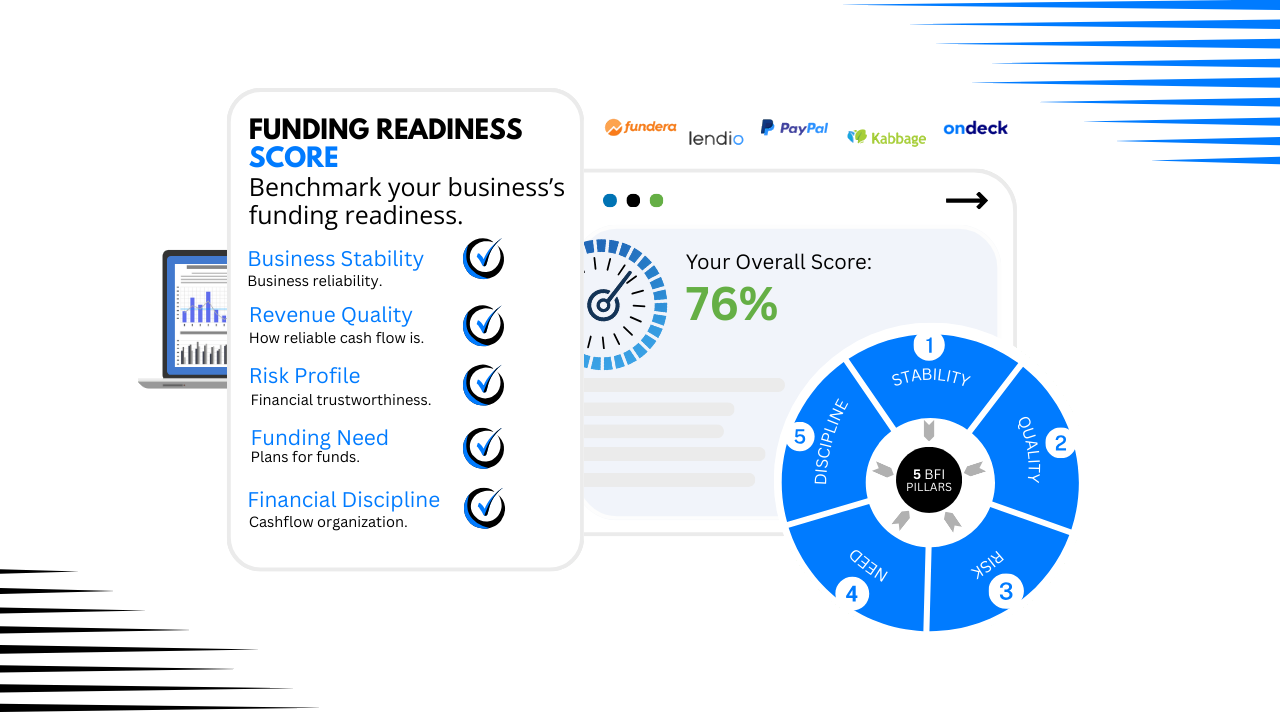

Many small business owners think they need a bank loan — when what they really need first is clarity on how fundable their business actually is. Our quick Biz Funding Readiness Check evaluation can show where you stand with lenders and what, if anything, needs to improve before moving forward.

Start My Funding Readiness Check

Start My Funding Readiness Check

Introduce your idea

How it works

➜ Answer 18 quick questions across the five essential areas of funding.

In 5 minutes or less, you’ll receive a personalized Funding Readiness Report

designed to increase your approval odds and help you secure the capital your business needs.

Data-Driven Questions

Our assessment uses lender-focused questions based on the exact factors that influence

approval odds, funding amounts, and access to better terms.

Comprehensive Funding Scores

After completing the check, you’ll receive an overall Funding Readiness Score

plus clear insights into each of the five critical areas lenders evaluate.

Customized Funding Report

Get a tailored roadmap with actionable steps to strengthen your funding profile,

improve approval likelihood, and position your business for the best possible offers.

Unlock better funding opportunities with our assessment.

Copyright © 2024 1800BizFunds. All Rights Reserved.